Like other public and private banks, Andhra Pradesh Grameena Vikas Bank also offering all banking products and services to its rural and urban customers such as Deposits, Loans, NRI Services, Lockers facility, ATM facility, Online Banking, etc.

It covers all the districts from Andhra Pradesh & Telangana states in India including Mahabubnagar, Nalgonda, Medak, Warangal, Khammam, Visakhapatnam, Vizianagaram and Srikakulam. Andhra Pradesh Grameena Vikas Bankis largest bank among grameena banks in India with objective to increase the participation of the bank in Rural Farm Sector and Rural Non-Farm Sector, with full of energy.

APGVB owned by government with 50% stack, Government of Andhra Pradesh: 15% stack and State Bank of India: 35% stack and operates through a large number of branches (755) spread across 8 districts in Andhra Pradesh & Telangana states in South India.

Andhra Pradesh Grameena Vikas Bank Savings Bank Account Interest Rate

Savings Account by APGVB is offered to cultivate the saving habit among the small depositors covering both non-business and non-commercial population. These accounts can be opened and operated by the Individuals singly or jointly, Professionals, Clubs, Associations, Charitable Trusts, Religious Institutions, Government bodies established under specific Acts. The account provides nomination facility, cheque book, passbook/ account statement, debit card, standing instructions for payment of utility bills, online banking facility, etc.

The rate of interest of Andhra Pradesh Grameena Vikas Bank Savings Bank Account is 4% p.a. calculated on daily basis. Minor Savings Bank Account is also there which offers interest rates at 4.50% p.a.

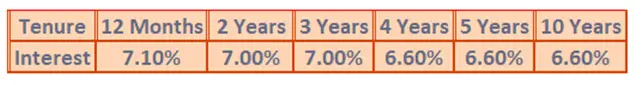

Andhra Pradesh Grameena Vikas Bank Term Deposit/ Fixed Deposit (FD) Interest Rate

Fixed deposits accounts with APGVB are available for the period from 15 days to 10 years with attractive interest rates. Minimum amount required for FD is Rs 100/-. Auto renewal and premature closure facilities is also there. These accounts can be opened and operated by the Individuals singly or jointly or a minor represented by the Guardian, HUF, Legal business entities, Companies, Clubs, Trusts and Government Departments. The account provides nomination facility as well.

Given below is the table for Term Deposit/ Fixed Deposit (FD) interest rate by the Andhra Pradesh Grameena Vikas Bank.

Andhra Pradesh Grameena Vikas Bank Recurring Deposit (RD) Interest Rate

Recurring deposit is a product which is best suited for salaried and regular income groups with monthly saving of specified amount for a fixed period. Recurring deposits accounts with APGVB are available for the period from 15 days to 10 years with attractive interest rates. Minimum amount required for FD is Rs 100/-. Nomination, auto renewal and premature closure facilities is also there. These accounts can be opened and operated by the Individuals singly or jointly or a minor represented by the Guardian, HUF, Legal business entities, Companies, Clubs, Trusts and Government Departments.

Given below is the table for Recurring Deposit (RD) interest rate by the Andhra Pradesh Grameena Vikas Bank.

Other deposit products offered by Andhra Pradesh Grameena Vikas Bank

Vikas Ubhaya Tharaka Tax Saving Scheme: This scheme a tax saving scheme which is eligible for deduction from income under Section 80 (C) of Income Tax Act, 1961. The amount of investment is restricted up to Rs.1.5 lakhs with a fixed period of 5 years.

Vikas 18: This is a special deposit scheme having a fixed tenure of 18 months. It offers 7.10% interest to general public and 7.60% interest to the senior citizens. The principal amount is Rs. 18,000. The maturity value for general public will be Rs. 20,004 and for senior citizens Rs. 20,152 after 18 months.

VikasDhanaVarsha: This is a special deposit scheme having a tenure of less than 36 months (< 3 years). It offers 7.00% interest to general public and 7.20% interest to the senior citizens. The principal amount is between Rs. 1,00,000 to Rs. 5,00,000 which will always be in multiples of Rs. 1,00,000. The maturity value will be calculated on the basis of tenure opted by the customers at the mentioned interest rates.

VikasPatra: This is a special deposit scheme having a fixed tenure of 36 months (3 years). It offers 6.60% interest to general public and 7.10% interest to the senior citizens. The principal amount is minimum Rs. 800 and then in multiples of Rs. 800. The maturity value of Rs. 800 invested will be Rs. 974 for general public and Rs. 988 for senior citizens after 36 months.

Vikas 51: This is a special deposit scheme having a fixed tenure of 60 months. It offers 6.60% interest to general public and 7.10% interest to the senior citizens. The principal amount is Rs. 51,000. The maturity value for general public will be Rs. 70,749 and for senior citizens Rs. 72,509 after 60 months.

Non-Resident External Rupee account scheme (NRE Account): A person who holds an NRI status is eligible to open and operate an NRE Account. For NRE deposits minimum tenor would be 12 months. Joint account can also be opened but each account holder should be an NRI.

Non-Resident Ordinary Rupee account scheme (NRO Account): A person who holds an NRI status is eligible to open and operate an NRO Account. Joint account can also be opened with residents as well.

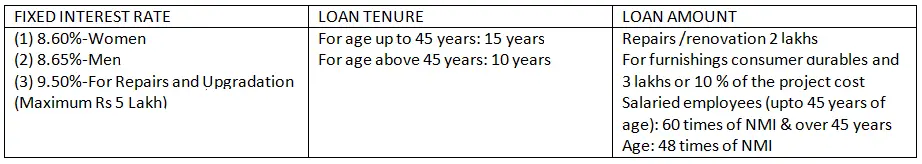

House Building Loans to Public by Andhra Pradesh Grameena Vikas Bank

Individuals can apply for home loan for any one of the following purposes:

- Purchase / construction of new/old house/flat.

- Repairing/renovating an existing house/flat.

- Furnishing the house/consumer durables as a part of project cost.

- Take over of loans from other banks subject to conditions.

Andhra Pradesh Grameena Vikas Bank Home Loan Interest Rates

Individuals can apply for home loan for any one of the following purposes:

- Purchase / construction of new/old house/flat.

- Repairing/renovating an existing house/flat.

- Furnishing the house/consumer durables as a part of project cost.

- Take over of loans from other banks subject to conditions.

Here full details of Home Loan are not mentioned. Please click here to see complete details of home loan by Andhra Pradesh Grameena Vikas Bank.

Please clic here to get the details of 10 Best Gramin Banks for providing lowest interest rates.

Andhra Pradesh Grameena Vikas Bank Education Loan Interest Rates

The main objective of providing education loan is to give financial assistance to deserving| meritorious students pursuing higher education in India and abroad.

Here full details of Education Loan are not mentioned. Please click here to see complete details of home loan by Andhra Pradesh Grameena Vikas Bank.

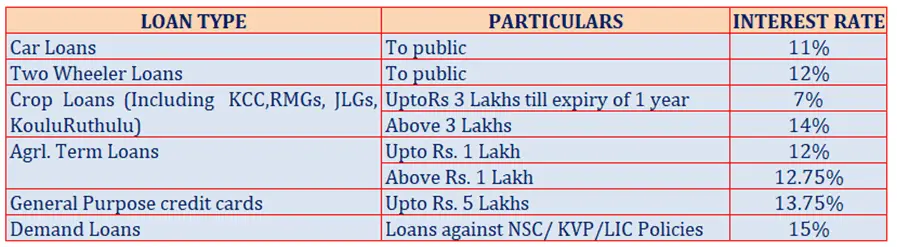

Car Loans, Two Wheeler Loans, Crop Loans (Including KCC,RMGs, JLGs, KouluRuthulu), Agrl. Term Loans and Demand Loans by Andhra Pradesh Grameena Vikas Bank

Other banking services offered by Andhra Pradesh Grameena Vikas Bank

- All branches provide Core Banking facility (CBS)

- Lockers facility available.

- DDCP (Demand Drafts and Cheques Purchase) facility

- Collection of Outstation Cheques

- Issue of Demand Drafts on our Branches

- Issue of Bank Guarantees

- Issue of Solvency Certificate

- NEFT & RTGS facility

- ATM Debit Card & Kisan Credit card facility

Contact Details of Andhra Pradesh Grameena Vikas Bank

Popular Posts

-

Bank Holiday List for Lok Sabha Election 26 April 2024

24 Apr 2024

-

How to Invest in SBI Sarvottam FD Scheme 2024?

24 Apr 2024

-

BRKGB Premium Saral Vyapar Rin Yojna

20 Apr 2024

-

RBI Floating Rate Savings Bond 2024

20 Apr 2024

-

Baroda UP Bank Tractor Loan

20 Apr 2024

-

Aryavart Rural Housing Loan Scheme

20 Apr 2024

-

Telangana Grameena Bank MSE Loans

26 Mar 2024

-

Saptagiri Grameena Bank Variable Recurring Deposit

26 Mar 2024

-

All About Chaitanya Godavari Grameena Bank Mobile App CGGB Money 2.0

26 Mar 2024

-

Saptagiri Grameena Bank Plot Loan Scheme

26 Mar 2024