When it comes to see the performance of the Gramin Banks, Gramin Banks present in Bihar are the major winners. There are 3 Gramin Banks/ Regional Rural Banks (RRB) providing the banking facilities to the population located in Bihar not only in the urban areas but in the semi-urban, rural and far rural areas.

These three Gramin Banks in Bihar are:

- Bihar Gramin Bank

- Madhya Bihar Gramin Bank

- Uttar Bihar Gramin Bank

Here, I am focussing only on the working and functioning of Uttar Bihar Gramin Bank covering 8 major districts of North Bihar which is sponsored by Central Bank of India and has its headquarters at Muzaffarpur. Uttar Bihar Gramin Bank (UBGB) is the largest RRB in India in terms of customer base, branch network and number of employees.

Uttar Bihar Gramin Bank (UBGB) offers all the banking products and services to its customers such as Deposits, Loans, NRI Services, Lockers, ATM facility, Online Banking, etc. You will find below segment-wise details of Uttar Bihar Gramin Bank (UBGB).

Uttar Bihar Gramin Bank (UBGB) Savings Bank Account Interest Rate

The rate of interest of Uttar Bihar Gramin Bank (UBGB) Savings Bank Account is 4% p.a. calculated on daily basis. Some additional benefits will be given to savings account holders like Debit Card facility, Free personal insurance of upto Rs. 1 Lakh with each debit card, cheque book, facility of standing instructions, etc.

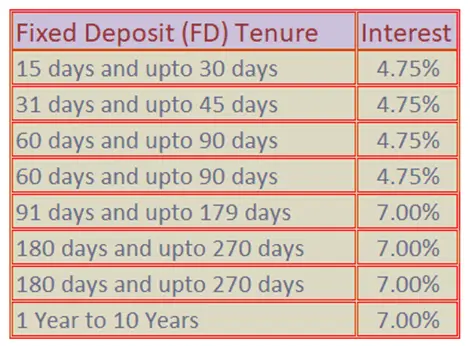

Uttar Bihar Gramin Bank (UBGB) Term Deposit/ Fixed Deposit (FD) Interest Rate

Tenure: from 15 days to 10 years

Given below is the table for Term Deposit/ Fixed Deposit (FD) interest rate by the Uttar Bihar Gramin Bank (UBGB).

Uttar Bihar Gramin Bank (UBGB) Term Deposit/ Fixed Deposit (FD) Interest Rate for Senior Citizen

Tenure: from 15 days to 10 years

Given below is the table for Term Deposit/ Fixed Deposit (FD) interest rate by the Uttar Bihar Gramin Bank (UBGB) for Senior Citizen

Uttar Bihar Gramin Bank (UBGB) Recurring Deposit (RD) Interest Rate

Recurring deposit is a product which is best suited for salaried and regular income groups with monthly saving of specified amount for a fixed period. Recurring deposits accounts with UBGB are available for the period from 15 days to 10 years with attractive interest rates.

Given below is the table for Recurring Deposit (RD) interest rate by the Uttar Bihar Gramin Bank (UBGB)

Uttar Bihar Gramin Bank (UBGB) Recurring Deposit (RD) Interest Rate for Senior Citizen

Senior Citizens are offered more interest rate on RDs.

Given below is the table for Recurring Deposit (RD) interest rate by the Uttar Bihar Gramin Bank (UBGB) for Senior Citizen

Other deposit products offered by Uttar Bihar Gramin Bank (UBGB)

The bank offers following deposit products to suit different classes of customers:

(555 Days) Gramin Super Deposit Scheme: This is a special deposit scheme having a fixed tenure of 555 days. It offers 6.50% interest to general public and 7.00% interest to the senior citizens which will be compounded quarterly. The principal amount is minimum of Rs. 1,000 and then in multiples of Rs. 1,000. The maturity value will be calculated on the basis of amount deposited by the customers at the mentioned interest rates. Loan facility is also available.

Gramin Swa-ShaktiFlexi Recurring Deposit: This scheme is for introduced for those customers who want to deposit monthly instalments of varied amounts i.e. different amount every month. The tenure is from 6 month to 120 months. Minimum deposit is Rs. 100 and then in multiples of Rs. 100 (maximum limit Rs 1,00,000).

Money Multiplier Deposit Scheme: This scheme is for introduced for those customers who want to deposit the amount from 6 month to 120 months. Minimum deposit is Rs. 1,000 and there is no maximum limit on deposit amount. There will be quarterly compounding of interest.

Gramin Tax Saving Scheme: This scheme a tax saving scheme which is eligible for deduction from income under Section 80 (C) of Income Tax Act, 1961. The amount of investment starts from Rs. 100 but is restricted up to Rs.1.5 lakhs with a fixed period of 5 years.

Gramin Lakhpati Recurring Deposit Scheme: This scheme is a recurring deposit scheme that helps you build a capital of Rs 1 lakh or more. Minimum deposit per month is Rs 100/-. The scheme is available for 12, 24, 36, 48 and 60 months.

Uttar Bihar Gramin Bank (UBGB) Home Loan Scheme

The bank offers home loan for construction of new House, Purchase of new house/ flat and for house repairing , renovation and extension.

Here full details of Home Loan are not mentioned. Please click here to see complete details of home loan by Uttar Bihar Gramin Bank (UBGB).

Please click here to get the details of 10 Best Gramin Banks for providing lowest interest rates.

Uttar Bihar Gramin Bank (UBGB) Kisan Credit Card

Uttar Bihar Gramin Bank (UBGB) Kisan Credit Card is issued to provide adequate and timely credit support to farmers for agriculture. Interest rate is 7 % upto 3 lakhs and 12 % above 3 lakhs. Crop Insurance and Personal Accidental Insurance is provided to the card holders at very nominal charges. KCC RuPay card is available which can be used in any ATM in the country. Additionally, Accidental Insurance on RuPay Card is available upto Rs.1 Lakh without Premium, if transaction took place using card within last 45 days of accident. The validity of the card is from 1 Year to maximum 5 Years.

Uttar Bihar Gramin Bank (UBGB) Education Loan

The main objective of providing education loan is to give financial assistance to deserving| meritorious students pursuing higher education in India and abroad.

Car Loans, Two Wheeler Loans, Rajiv Rin Yojana, Agri Land, Tractor Loan, Dairy Loan, Fishery Credit Card, Cash Credit and Mortgage Loan by Uttar Bihar Gramin Bank (UBGB)

You may be interest in calculating EMI on the loan amount. For it, just CLICK HERE

Other banking services offered by Uttar Bihar Gramin Bank (UBGB)

- Core Banking facility (CBS)

- Lockers facility available.

- DDCP (Demand Drafts and Cheques Purchase) facility

- Collection of Outstation Cheques

- Issue of Demand Drafts on the Branches

- NEFT & RTGS facility

- ATM Debit Card & Kisan Credit card facility

Uttar Bihar Gramin Bank (UBGB) Financial Inclusion (FI) Products

- Gramin Vikas Khata: SB account with inbuilt overdraft facility. Overdraft of Rs 500 is available from the moment of opening, maximum Rs 2,500.

- Smart Flexi RD: Flexibility in monthly deposit amount in RD. The tenure is from 6 month to 120 months.

- Micro Kisan Credit Card: Production credit is given to agriculturists up to Rs 25000 through BCs.

- Micro GCC: Production credit is given to non-agriculturists up to Rs 10000 through BCs.

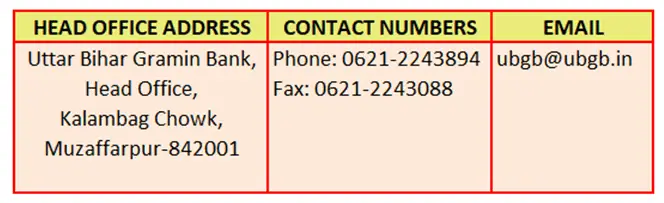

Contact Details of Uttar Bihar Gramin Bank (UBGB)

Popular Posts

-

NRO Recurring Deposit Account with FAQs 2024

25 Apr 2024

-

Deposit Rs.5000 and Get Rs.3.56 lakhs in Post Office Scheme 2024

25 Apr 2024

-

Bank Holiday List for Lok Sabha Election 26 April 2024

24 Apr 2024

-

How to Invest in SBI Sarvottam FD Scheme 2024?

24 Apr 2024

-

BRKGB Premium Saral Vyapar Rin Yojna

20 Apr 2024

-

RBI Floating Rate Savings Bond 2024

20 Apr 2024

-

Baroda UP Bank Tractor Loan

20 Apr 2024

-

Aryavart Rural Housing Loan Scheme

20 Apr 2024

-

Telangana Grameena Bank MSE Loans

26 Mar 2024

-

Saptagiri Grameena Bank Variable Recurring Deposit

26 Mar 2024