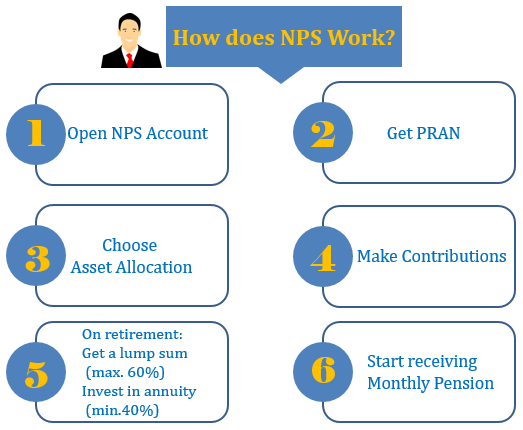

How does NPS Work?

Under the National Pension System (NPS), first of all you need to open a NPS account then you will be allotted a Permanent Retirement Account Number (PRAN). After that you need to choose asset allocation for your contributions. Next step is to make contribution to NPS and keep contributing every year as per your choice. Once the fund is collected, it is invested in designated investment plans through Pension Fund Managers (PFMs).

On retirement, you can get a lump sum amount (max. 60% of your NPS corpus) and balance (at least 40%) will be invested in annuity plan. You have the option to choose the annuity plan. Then you will start receiving monthly pension.

It is to be noted that a government employee contributes to the pension plan from his monthly salary along with similar amount from his employer.

It is easy to understand the working of NPS with diagram. You can go through the working of NPS with the help of following step-wise presentation: