How Can You Maximise Earning through Peer to Peer Lending Platform?

By Anupama Deshpande | Feb 22, 2019

In India, banks and other financial institutions have been the major sources for providing loan and credits to the needy people. They are considered as traditional sources of offering funds to the borrowers. While extending credit, banks and other NBFCs follow a stringent credit assessment process in order to determine whether loan can be extended to any applicant or not considering collateral submitted by the applicant and his/ her past credit history. For many of the persons this process becomes complex as they do not fulfil these criteria.

For those applicants, who do not have any collateral to pledge or have poor or no credit history, it becomes difficult to avail loans from such institutions. Such loan applicant are not offered loan from traditional lenders even if they are ready to pay more interest on loan. To cater to the needs of funds of such borrowers, idea of Peer to Peer Lending emerged.

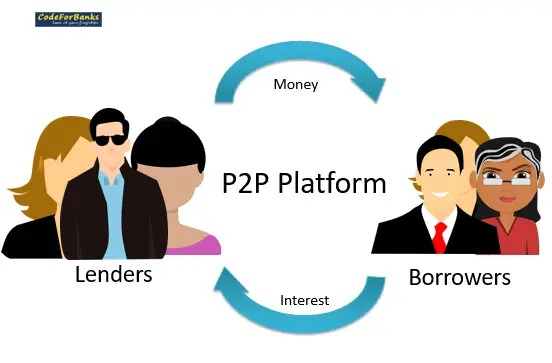

Peer to Peer (P2P) Lending Platform is a virtual platform which facilitates both the borrowers and lenders to interact directly using online services. It is an innovative and new-age marketplace giving opportunity to borrowers to avail loans with ease and to lenders to invest and earn much higher returns on their funds. The middleman is removed from the process.

Suggested reading How can P2P Lending in India Be a Boon?

P2P lending concept came into being in India since early 2014. Until September 2017, P2P lending Service providers were not being regulated by any authority. In Sep 2017, RBI has notified P2P lending service providers will have to be registered as non-banking financial companies (NBFCs).

The size of the Indian P2P lending industry is approximately Rs. 200 crore.

Those borrowers opt for P2P lending platform for availing loan who have not got approval for by standard financial institutions like banks and NBFCs. Further, unlike banks & NBFCs, application is processed very easily and quickly. P2P lending facilitates lenders/ investors to extend loans to individuals/ companies through their online platform with limited risk.

The borrower has to create a borrower account in P2P lending platform and also upload required supporting documents along with mention of required loan amount. After that P2P lending platform checks the fitness of the borrower through its in-built risk assessment model. If it accepts the loan proposal then it lists the loan in its P2P lending platform. After listing, the lenders can see and consider the loan proposal for extending the loan.

From the point of view of lenders (investors), there are following points as to how can you maximise earning through Peer to Peer Lending Platform:

(1) Offer Higher Returns

As compared to other investment avenues, P2P lending platform offers higher returns to the lenders (investors). The returns enjoyed by the lenders are in the range of 18% to 26% p.a. which are much higher than that of other instruments.

Suggested reading Beneficial Insights of Business Loan

(2) Get Regular Income

Lenders/ Investors can earn monthly returns in the form of principal repayment and interest. There is no lock-in period for investment.

(3) Reinvest Regular Monthly Income to Enjoy Compounding Returns

If the Lenders/ Investors do not wish to get monthly income then there is an option that they can maximise their returns by reinvesting their monthly income and can get compounding returns on their investment.

Suggested reading Points to remember while investing in Debt Mutual Funds

Anupama is a Co-Founder of CodeForBanks.com. She is an MBA (Finance) and Chartered Financial Analyst (CFA). She also carries a Fellowship degree in Life Insurance Sector and is a Master of Computer Application (MCA). She is an expert in Finance Field with an experience of over 18 years on different managerial positions in finance industry including Stock Market, Depository and Mutual Fund Sectors. Apart from that she has remained for few years in the field of marketing as well. Her suggestions and advice for investments have been very useful to many people.

Anupama is a Co-Founder of CodeForBanks.com. She is an MBA (Finance) and Chartered Financial Analyst (CFA). She also carries a Fellowship degree in Life Insurance Sector and is a Master of Computer Application (MCA). She is an expert in Finance Field with an experience of over 18 years on different managerial positions in finance industry including Stock Market, Depository and Mutual Fund Sectors. Apart from that she has remained for few years in the field of marketing as well. Her suggestions and advice for investments have been very useful to many people.Her vast interest & expertise in the field of finance have encouraged her to write the articles so that others can also get benefitted out of them. She never loses any opportunity to learn and be creative. She is a valuable asset for CodeForBanks.com & important resource to all those around her.