There are all types of banks operating all across India such as Public Banks, Private Banks, Foreign Banks, Co-operative Banks, Small Finance Banks, Payments Banks, etc. One of such banks is Gramin Bank, also known as Regional Rural Bank (RRB). The unique features which are found in a gramin banks is that they are operating on state level and they are found even in most rural areas where other banks don't have their branches/ operations.

There are 3 Gramin Banks in the state of Madhya Pradesh. These banks are:

- Central Madhya Pradesh Gramin Bank

- Madhyanchal Gramin Bank

- Narmada Jhabua Gramin Bank

Here, I am covering Central Madhya Pradesh Gramin Bank which offers all the banking products and services to its customers such as Deposits, Loans, NRI Services, Kisan Credit Cards, Debit Cards, Lockers, ATM facility, Online Banking, and many more. You will find below segment-wise details of Central Madhya Pradesh Gramin Bank.

Central Madhya Pradesh Gramin Bank Savings Bank Account Interest Rate

The rate of interest of Central Madhya Pradesh Gramin Bank Savings Bank Account is 4% p.a. calculated on daily basis. Some additional benefits will be given to savings account holders like Debit Card facility, bank account statement, passbook, cheque book, facility of standing instructions, online banking, RTGS/ NEFT, etc.

Central Madhya Pradesh Gramin Bank Term Deposit/ Fixed Deposit (FD) Interest Rate

Tenure: from 7 days to 10 years

Given below is the table for Term Deposit/ Fixed Deposit (FD) interest rate by the Central Madhya Pradesh Gramin Bank:

| Tenure | Interest Rate p.a. (%) |

|---|---|

| 7 days to 14 days | 4 |

| 15 days to 30 days | 4.25 |

| 31 days to 45 days | 4.25 |

| 46 days to 60 days | 5 |

| 61 days to 90 days | 5 |

| 91 days to 179 days | 6 |

| 180 days to 269 days | 6.5 |

| 270 days to 364 days | 6.75 |

| 1 year to less than 2 years | 6.75 |

| 2 years to less than 3 years | 6.5 |

| 3 years to less than 5 years | 6.5 |

| 5 years and upto 10 years | 6.25 |

Central Madhya Pradesh Gramin Bank Term Deposit/ Fixed Deposit (FD) Interest Rate for Senior Citizen

Tenure: from 7 days to 10 years

Given below is the table for Term Deposit/ Fixed Deposit (FD) interest rate by the Central Madhya Pradesh Gramin Bank for Senior Citizen

| Tenure | Interest Rate p.a. (%) |

|---|---|

| 7 days to 14 days | 4.5 |

| 15 days to 30 days | 4.75 |

| 31 days to 45 days | 4.75 |

| 46 days to 60 days | 5.5 |

| 61 days to 90 days | 5.5 |

| 91 days to 179 days | 6.5 |

| 180 days to 269 days | 7 |

| 270 days to 364 days | 7.25 |

| 1 year to less than 2 years | 7.25 |

| 2 years to less than 3 years | 7 |

| 3 years to less than 5 years | 7 |

| 5 years and upto 10 years | 6.75 |

Central Madhya Pradesh Gramin Bank Recurring Deposit (RD) Interest Rate

Recurring deposit is a product which is best suited for salaried and regular income groups with monthly saving of specified amount for a fixed period. Recurring deposits accounts with Central Madhya Pradesh Gramin Bank are available for the period from 1 Year to 10 years with attractive interest rates.

Given below is the table for Recurring Deposit (RD) interest rate by the Central Madhya Pradesh Gramin Bank

| Recurring Deposit (RD) | 1 Year | 2 Years | 3 Years | 4 Years | 5 Years | 10 Years |

|---|---|---|---|---|---|---|

| Interest | 6.75 | 6.5 | 6.5 | 6.5 | 6.25 | 6.25 |

Central Madhya Pradesh Gramin Bank Recurring Deposit (RD) Interest Rate for Senior Citizen

Senior Citizens are offered more interest rate on RDs.

Given below is the table for Recurring Deposit (RD) interest rate by the Central Madhya Pradesh Gramin Bank for Senior Citizen

| Recurring Deposit (RD) | 1 Year | 2 Years | 3 Years | 4 Years | 5 Years | 10 Years |

|---|---|---|---|---|---|---|

| Interest | 7.25 | 7 | 7 | 7 | 6.75 | 6.75 |

Other Deposit Schemes offered by Central Madhya Pradesh Gramin Bank

Central Madhya Pradesh Gramin Bank CentMP Super Deposit Scheme

The account may be opened for a period of 555 days with Min Amount:Rs.1000 Max Amount:Rs.1 crore. On maturity of the period payment is made with compounding of interest. Nomination facility is also available in this account.

Central Madhya Pradesh Gramin Bank CentMP Double Deposit Scheme

Your amount will be doubled in 93 months for general and in 90 months for senior citizens. Limit of Min Amount:Rs.5000 Max Amount:Rs.1 crore. On maturity of the period payment is made with compounding of interest. Nomination facility is also available in this account.

Central Madhya Pradesh Gramin Bank CentMP Special Deposit Scheme:

The account may be opened for a period of 300 days with Min Amount:Rs.1000 Max Amount:Rs.1 crore. Payment before maturity of the deposit is available subject to Bank's rules in this regard

Central Madhya Pradesh Gramin Bank CentMP Lakhpathi Recurring Deposit Scheme:

It is a kind of recurring account for common public account may be opened with an amount Rs.1350/- which is to be deposited every Month. Maturuty is after 60 months. On maturity of the period payment is made with compounding of interest.

Central Madhya Pradesh Gramin Bank CentMP Tax Savings Scheme:

It is designed for claiming Tax benefits under Sec 80 C of IT Act,1961 for common public account may be opened with Min Amount:Rs.1,000 Max Amount:Rs.1.5 Lakhs. Maturuty is after 5 years. On maturity of the period payment is made with compounding of interest.

Central Madhya Pradesh Gramin Bank Loan Schemes for Agriculture Sector

The bank offers following deposit products to suit different classes of customers:

Central Madhya Pradesh Gramin Bank CentMP Kisan Credit Card: This scheme provides hassle free loan to the Farmers on the cheapest rates of interest for their main activity i.e. Crop Production & also to meet out their personal & consumption needs to some extent.

Central Madhya Pradesh Gramin Bank CentMP Warehouse Finance: This scheme is for Warehouse Finance to the Farmers & provides hassle free loan to the Farmers on the cheapest rates of interest.

Central Madhya Pradesh Gramin Bank CentMP Dairy Loan: This loan is provided for purchase of Buffaloes, Cows and cross breed Cows. Finance as per Unit cost. Repayment is due after 5 years.

Central Madhya Pradesh Gramin Bank CentMP General Credit Card: In order to provide loans for general credit needs to our individual customers in the rural & Semi urban areas in a hassle free manner based on the assessment of cash flow of the entire household without insistence on security.

Central Madhya Pradesh Gramin Bank CentMP Kisan Vehicle Loan: The bank is providing financial assistance to the farmers for purchase of motor-cycle.

Central Madhya Pradesh Gramin Bank CentMP Swarojgar Credit Card: The purpose of this scheme is to provide timely & adequate capital or working capital or both to small artisans, Handloom weavers, Service sector, fisherman, Self employed person , Rickshaw pullers and small entrepreneurs, SHG etc.

Central Madhya Pradesh Gramin Bank Home Loan Scheme

To provide financial support for Construction of new dwelling unit, purchasing of new/old dwelling units which are not older than 30 years. Extension of existing house. Purchase of plot of land subject to the condition that a house will be constructed thereon within -2- years from the date of purchase of plot.

| LOAN TENURE | FLOATING INTEREST RATE | LOAN AMOUNT |

|---|---|---|

| Maximum 25 years |

| Max. Rs. 100 lakhs |

Here full details of Home Loan are not mentioned. Please click here to see complete details of home loan by by Central Madhya Pradesh Gramin Bank.

Please click here to get the details of 10 Best Gramin Banks for providing lowest interest rates.

Central Madhya Pradesh Gramin Bank Education Loan

The main objective of providing education loan is to give financial assistance to deserving| meritorious students pursuing higher education in India and abroad.

| INTEREST RATE | LOAN TENURE | LOAN AMOUNT |

|---|---|---|

| BPLR-1 i.e. 11.50%-for boys & BPLR-1.5 i.e. 11%-for girls | In 5 to 7 years after the Holiday or Moratorium Period (Course Period + One year or 6 months after getting the job) | Need based finance to meet expenses as worked out under "Expenses considered for Loan" |

Here full details of Education Loan are not mentioned. Please click here to see complete details of home loan by by Central Madhya Pradesh Gramin Bank.

Please click here to get the details of 10 Best Gramin Banks for providing lowest interest rates for education loan.

Central Madhya Pradesh Gramin Bank Car Loan

To purchase a car for personal use. Used car should not be older more than 3 years. The details are as follows:

| INTEREST RATE | LOAN TENURE | LOAN AMOUNT |

|---|---|---|

| BPLR-1.5 i.e. 11% |

|

|

You may be interest in calculating EMI on the loan amount. For it, just CLICK HERE

Central Madhya Pradesh Gramin Bank Two Wheeler Loan

To provide term loan for purchasing two wheeler. All creditworthy customers having sufficient income to repay the loan instalments. The details are as follows:

| INTEREST RATE | LOAN TENURE | LOAN AMOUNT |

|---|---|---|

| BPLR-1.5 i.e. 11% | Maximum 5 years | Up to 75 % of the invoice value |

Other banking services offered by Central Madhya Pradesh Gramin Bank

- All branches provide Core Banking facility (CBS)

- Lockers facility available.

- Demand Drafts and Cheques Purchase facility

- Collection of Outstation Cheques

- Collection of Outstation Bills

- Standing Instruction

- Issue of Bank Guarantees

- Issue of Solvency Certificate

- SMS Alert, TDS Certificate, Interest Certificate and Balance Certificate

- NEFT & RTGS facility

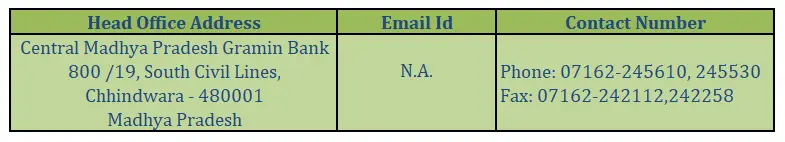

Central Madhya Pradesh Gramin Bank Contact Details

Popular Posts

-

NRO Recurring Deposit Account with FAQs 2024

25 Apr 2024

-

Deposit Rs.5000 and Get Rs.3.56 lakhs in Post Office Scheme 2024

25 Apr 2024

-

Bank Holiday List for Lok Sabha Election 26 April 2024

24 Apr 2024

-

How to Invest in SBI Sarvottam FD Scheme 2024?

24 Apr 2024

-

BRKGB Premium Saral Vyapar Rin Yojna

20 Apr 2024

-

RBI Floating Rate Savings Bond 2024

20 Apr 2024

-

Baroda UP Bank Tractor Loan

20 Apr 2024

-

Aryavart Rural Housing Loan Scheme

20 Apr 2024

-

Telangana Grameena Bank MSE Loans

26 Mar 2024

-

Saptagiri Grameena Bank Variable Recurring Deposit

26 Mar 2024