Can you believe that it is possible to start your investment with a Mutual Fund with an amount of as small as Rs. 100/-? Yes, it is absolutely true that you can invest even a small amount of Rs. 100/- in a Mutual Fund. This investment is made under Micro Systematic Investment Plan (Micro SIP). Many mutual funds such as Reliance Mutual Fund, ICICI Prudential Mutual Fund, etc. provide Micro SIP schemes where you can invest Rs. 100/- per month. So there is no need to worry for those who can save very small amount in a Mutual Fund.

What is Systematic Investment Plan (SIP)?

Let's first understand a Systematic Investment Plan (SIP)

Systematic investment plan is an effective way to do financial planning that allows you to invest a fixed amount regularly at a specified frequency say, weekly, monthly or quarterly according to your convenience in a mutual fund scheme. You can choose any plan according to your convenience and achieve your financial goals, systematically. In simple word, Systematic investment plan is a plan of wealth creation by small & regular investment in long run.

Systematic investment plan is a discipline approach of saving. When you start investing in SIP you promise yourself for save regularly. It is very flexible and convenient investment plan as you can increase or decrease the amount being invested. Systematic investment plan is a flexible and hassle free mode for investment.

Who should invest in SIP?

Systematic investment plans work best for investors who are seeking for long term goals, such as:

- Children's higher education

- Children's marriage

- Buy a four wheeler

- To build a house

- Medical Emergency

- Retirement Planning

Why should you invest in Equity SIP?

The features of systematic investment plan (SIP) that make it fit for equity market are:

- Among all types of investment instruments, equity has given highest returns in all times.

- Systematic investment plan is simple and disciplined approach towards investment.

- As investment is not made in lump sum, it reduces risk to a great instant as it helps you average out your cost.

- SIP based on concept of Rupee Cost Averaging and Power of Compounding.

- The returns received are totally tax free, if withdrawn after completion of 1 year from the date of investment.

- You can claim income tax rebate under section 80C of Income Tax Act, 1961, if you invest in ELSS scheme.

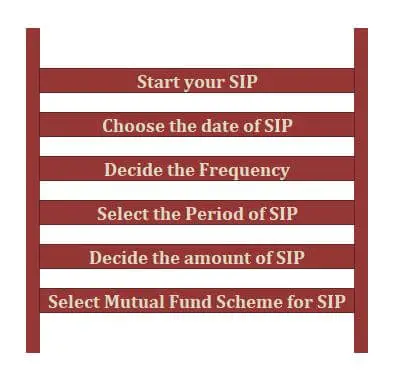

Simple steps of investing in SIP

I hope now you have understood the importance and benefits of investment in a Mutual Fund through an SIP route. Now don't wait and start your investment today!

Happy investing!

Popular Posts

-

How to Benefit from Income Tax Exemptions on Tax Saver FD 2024?

01 May 2024

-

PNB Car Loan Types with Interest Rate & FAQs 2024

30 Apr 2024

-

Last Date Extended: SBI FD Scheme with Interest Rate Upto 7.60%

29 Apr 2024

-

Earn FD interest rate up to 9.10%: These 7 Banks have Revised FD Rates April 2024

29 Apr 2024

-

Will Credit Card Usage for Rent and Tuition Fees Payment Banned?

26 Apr 2024

-

EMI for 50 Lakh PNB Home Loan and Interest Calculation 2024

26 Apr 2024

-

NRO Recurring Deposit Account with FAQs 2024

25 Apr 2024

-

Deposit Rs.5000 and Get Rs.3.56 lakhs in Post Office Scheme 2024

25 Apr 2024

-

Bank Holiday List for Lok Sabha Election 26 April 2024

24 Apr 2024

-

How to Invest in SBI Sarvottam FD Scheme 2024?

24 Apr 2024